Hello,

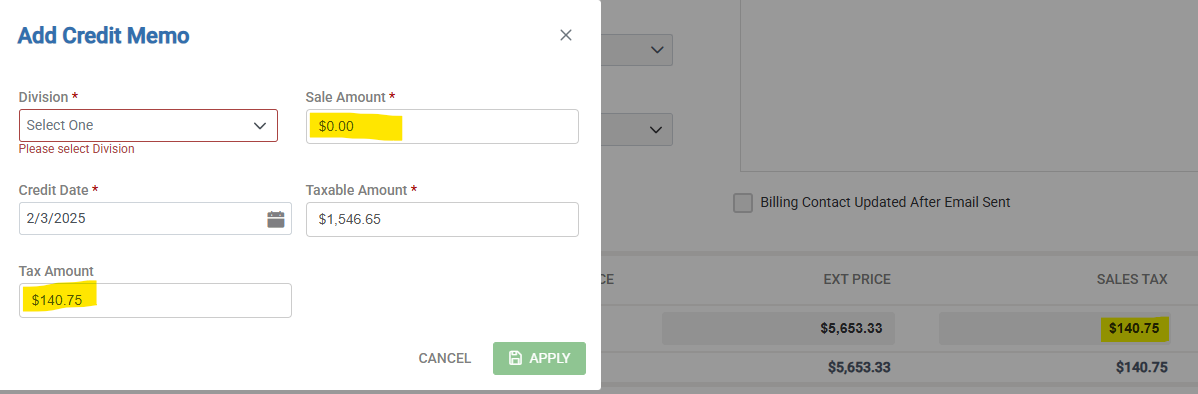

We have a few invoices that customers were supposed to be tax exempt, and they were charged tax on invoices. The customer paid the invoice leaving the tax unpaid. Is there anything that can be done to get rid of the tax, so it isn't showing on invoices as unpaid?